puttepong

In the U.S., for example, corporate bond issuances must be registered with the Securities and Exchange Commission (SEC). Once the initial planning is done, the issuer engages underwriters, typically investment banks. The underwriters help structure the bond offering, price the bonds, ensure legal compliance, and market the bonds to potential investors. In exchange for the loan, the issuer or borrower must make payments to the investors in the form of interest payments. The interest rate is often called the coupon rate, and coupon payments are made using a predetermined schedule and rate.

Debt Issuance Transaction Costs

By issuing debt, an entity is free to use the capital it raises as it sees fit. Since 1984, the district has passed six bond measures, the largest being a $250 million package in 2018. They pointed to needs surrounding building renovations and to two growing communities that need their own schools — Sterling Ranch and RidgeGate. The ballot language says the proposed bond will not impose a new tax, though it could potentially cost the public up to $895 million once the borrowing is fully paid. A rendering of Sterling Ranch Elementary School in Sterling Ranch, Colorado, where Douglas County School District officials plan to add an elementary school if voters approve a $490 million bond package in November. Would the Amort of DFF or OID be added back to EBITDA and is it included in EBIT?

FAR CPA Practice Questions: Calculating Interest Expense for Bonds Payable

There were no significant differences within either program on outcomes among demographic subgroups or different referral sources. In addition, it is important to note that residents were able to maintain improvements even after they left the SLHs. By 18 months nearly all had left, yet improvements were for the most part maintained.

FAR CPA Practice Questions: Capital Account Activity in Pass-through Entities

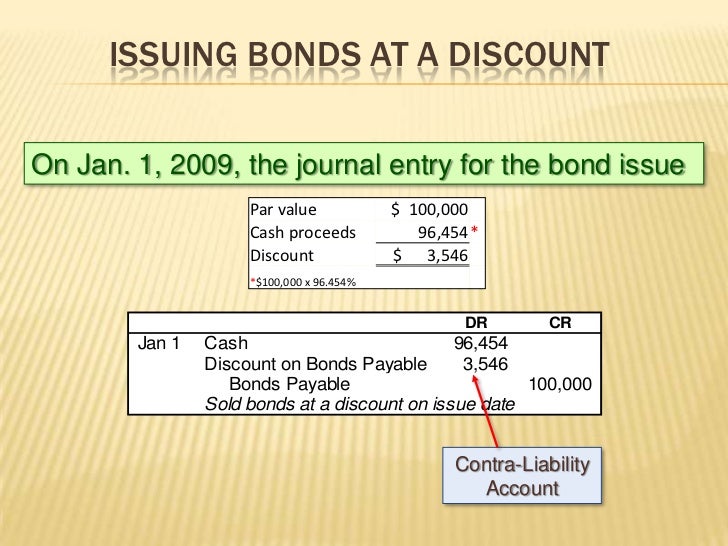

Under this new method, the company is required to record the debt issuance cost as the contra account of bonds payable. The issuance cost will reduce the bonds payable balance from $ 10 million on the initial recording. The journal entry is debiting debt issue expense $ 120,000 and credit debt issuance cost $ 120,000. IFRS suggests that the company must recalculate the interest rate using the effective interest method. The issuance cost is part of the finance cost that company spends to obtain the debt/bonds.

Ask Any Financial Question

These costs cover the production of physical documents, such as bond certificates, prospectuses, and other related materials. While the digital age has reduced the reliance on printed materials, certain regulatory and investor requirements still necessitate physical documentation. The extent of these costs can vary based on the volume of materials needed and the quality of the printing services used. Accurately accounting for printing costs ensures that all expenses related to the bond issuance are captured, providing a comprehensive view of the total costs incurred. Underwriting fees are payments made to investment banks or financial institutions that manage the bond issuance process. These institutions assume the risk of selling the bonds to investors and, in return, charge a fee for their services.

Legal Requirements for Issuing Bonds

Specifically, it helps residents resolve their mixed feelings (i.e., ambivalence) about living in the SLH and engaging in other community based services. Thus, the intervention is a way to help them prepare for the challenges and recognize the potential benefits of new activities and experiences. Our purpose here is to summarize the most salient and relevant findings for SLHs as a community based recovery option.

- A bond is a form of debt in which the issuer borrows money from investors, pays interest on the loan periodically or all at the end, and repays the loan when the bond matures.

- For instance, in a low-interest-rate environment, newly issued bonds with higher coupon rates are more attractive, increasing demand and hence their price.

- Furthermore, loans are usually negotiated directly between the parties involved, while bonds are typically sold on open markets, making them more liquid.

- For some individuals, the limited structure offered by freestanding SLHs could invite association with substance using friends and family and thus precipitate relapse.

- The fact that residents in SLHs make improvement over time does not necessarily mean that SLHs will find acceptance in the community.

The new update only changes the classification of debt issuance cost from assets to contra liability. The issuance cost will be present in only one line on the balance sheet with the bonds payable. Printing costs, though often smaller in scale compared to underwriting and legal fees, are still a necessary expense in the bond issuance process.

Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective bond issue costs analysis, and the opinions are our own. Issuing bonds provides a significant amount of capital, allows the issuer to maintain ownership control, and offers potential tax benefits as interest payments are usually tax-deductible.

A debt issue is essentially a promissory note in which the issuer is the borrower, and the entity buying the debt asset is the lender. When a debt issue is made available, investors buy it from the seller who uses the funds to pursue its capital projects. In return, the investor is promised regular interest payments and also repayment of the initial principal amount on a predetermined date in the future.

This Best Practice provides an overview of the types of costs and fees that an issuer can expect to pay in a typical bond transaction. Finance officers need to be aware of and understand the costs and fees that are charged in a bond transaction in order to ensure that the charges are reasonable and for legitimate services provided to the issuer. CSLT is located in Sacramento County California and consists of 16 houses with a 136 bed capacity.

On the issued date, the company has to record the balance of the asset on the balance sheet. At the end of the year, the company will make the adjusting entry to amortize the contra-liability account. Next, the issuer engages underwriters, prepares the bond prospectus, and seeks approval from regulatory bodies. Once approved, the bonds are marketed and sold to investors, thus finalizing the process. Equity financing refers to the process of raising capital by selling shares in a company. In exchange for capital, investors receive partial ownership of the company and may receive dividends if the company is profitable.

ที่อยู่

ฝ่ายกลยุทธ์วิจัยและถ่ายทอดเทคโนโลยี (SPD)

ศูนย์เทคโนโลยีอิเล็กทรอนิกส์และคอมพิวเตอร์แห่งชาติ (ศอ.)

ติดต่อเรา

![]() 025646900 ต่อ 2353

025646900 ต่อ 2353

![]() https://www.nectec.or.th/innovation/

https://www.nectec.or.th/innovation/

![]() HandySense Community

HandySense Community

-d4ff75bb7350389bb1c2c9c5ddb296c9.png)

-eff8c8e273d5863fdb02cf0bb7de785a.png)